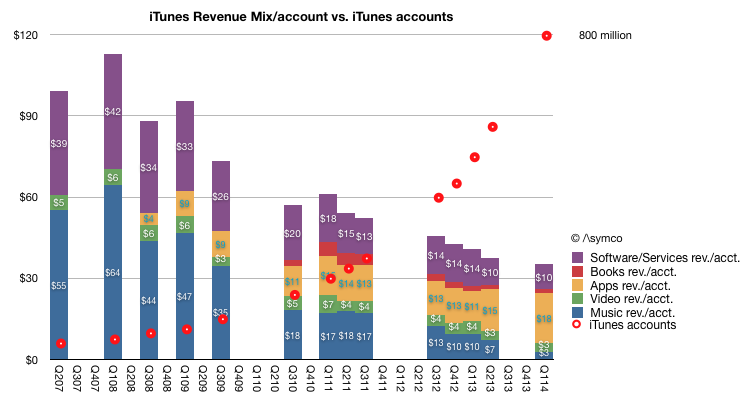

Following Apple’s most recent earnings report, Tim Cook revealed in a conference call with analyst that there are now more than 800 million iTunes accounts in use and said that “the majority of those have credit cards behind them.”

How does this compare to Amazon, the king of online commerce? Turns out that Apple actually has twice as many credit cards on file than Amazon, at least. This poses a tremendous opportunity should Apple decide to introduce a mobile payment service of its own, as expected…

Independent industry analyst Horace Dediu shared the above chart in a tweet this morning, highlighting the stunning gap between the two technology giants.

A few noteworthy highlights:

- Apple’s per-account iTunes revenue in the March quarter was $35 per year.

- The number of total iOS devices sold to date is 836 million units, which isn’t much higher than the 800 million iTunes accounts.

- There are approximately 329,000 iOS users added daily across all Apple products. A cool sixty million new registered users were added in the past six months alone.

- Amazon added nine million accounts in Q1 2013, nine million in Q1 2012 and seven million in Q1 2014.

- Throughout 2011, Amazon added 34 million new account. In 2012, the figure was 36 million. In 2013: 37 million.

- The Amazon data is not tablet specific so these active accounts are shoppers.

A disconnect between the number of active iTunes accounts and iOS devices exists because not all iOS devices are new purchases (many are upgrades). Besides, some folks own multiple iOS devices, some accounts don’t have a valid payment method attached and others are being used for stuff beyond payments.

For those wondering what counts as Software/Services in the chart below, it’s the App Store, Mac App Store, iBooks Store, iTunes Store, iCloud, iTunes Match, Apple’s pro apps, AppleCare and revenue from Google traffic acquisition costs on Apple’s mobile and desktop platforms.

OS X, iWork and iLife used to contribute to the category, too, before Apple switched to free OS X updates with the release of Mavericks and free iWork/iLife downloads with new iOS device purchases as of last September.

iTunes revenue per account.

It’s just startling.

Apple is a hardware company that runs a few online-only digital stores and sells both its own and third-party products via its online stores. Amazon is both an online commerce company and a physical goods reseller that sells way, way more digital and tangible items compared to Apple.

Dediu’s chart focuses on just the number of active credit cards on file. We don’t know which accounts are being used to purchase digital items such as apps and media in the App Store and iTunes Store and which ones get used for purchases of physical goods.

However, this is beyond point – an active credit card on file is an active credit card on file no matter what it’s being used for.

Sources told Re/code that Apple is “very, very serious” about mobile payments and Tim Cook hinted that mobile payments were “one of the thoughts behind Touch ID.”

iDownloadBlog has discovered that Apple is getting ready to roll out its sophisticated fingerprint reader across the entire iOS device family (it’s currently an iPhone 5s exclusive).

That being said, if there really is an Apple-branded mobile payment solution in the works, the established iTunes user base with credit cards on file will surely give Apple a huge lead over Amazon.

Assuming such a solution launched soon, would you be willing to pay for physical goods using your iTunes account?

No comments:

Post a Comment