What better way to manipulate AAPL than trash-talk the company on a Friday and let bloggers disseminate FUD? First, UBS analyst Steve Milunovich articulated his disappointment with iPad sales because the tablet in general “simply isn’t a must-have device” (I swear I’m not making this up).

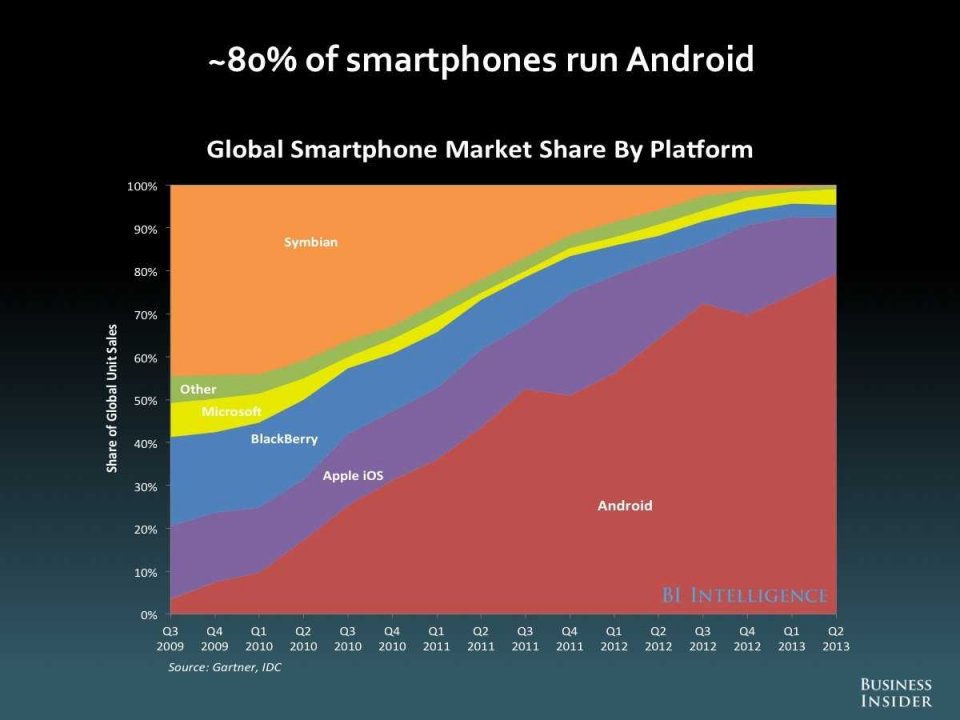

Next, Henry Blodget (who runs Business Insider) is back with his ‘iPhone dead in the water’ meme: Apple’s refusal to go for low-value customers has been ticking Blodget off for some time, even if the move carries the real risk of damaging the brand beyond repair.

Then, a Chinese blog asserts Apple is further trimming the iPhone 5c production as early adopters continue to prefer the flagship iPhone 5s. Finally we have Morgan Stanley creatively putting all of the Android tablets together – including those sold on the Moon plus sub-$50 no-names sitting in the drawer collecting dust – to proclaim Google’s platform a revenue winner.

Grab your popcorn and chillax…

First up is Steve Milunovich, an analyst with UBS, via BGR:

The analyst explained that he has been disappointed with Apple’s iPad sales and that tablets in general are at risk from sales of smartphones, phablets… and PCs. The tablet simply isn’t a “must-have” device, he explained.

Here’s your money quote (emphasis mine):

The smartphone is best at keeping people in contact with friends and family. The PC’s differentiation is to do work with productivity apps. The tablet is particularly good at entertainment.Content creation is the tablet’s Achilles heel. So far Apple appears okay with that but an alternative is to develop a convertible product aimed at a different job to be done.

I stopped reading at “content creation is the tablet’s Achilles heel”.

“The answer, it would seem, is a netbook,” BGR author Zach Epstein sarcastically remarked. For a NSFW take, see The Loop’s Jim Dalrymple, screenshoted below.

Next up is Henry Blodget, who ran a linkbait write-up on Business Insider titled ‘Come On, Apple Fans, It’s Time To Admit That The Company Is Blowing It’ which boils down to that it’s high time Apple went for low-value customers with cheap products.

Apple is losing smartphone share in China to dirt cheap local brands because the company is being “greedy and shortsighted and choosing to maintain its already fantastically high profit margins at the expense of market share,” his logic goes.

As if that weren’t enough, Blodget called Apple’s strong U.S. smartphone share “an anomaly”. This reminds me of the following Steve Ballmer quote from 2007:

There’s no chance that the iPhone is going to get any significant market share. No chance.

Blodget continues unabated:

If Apple continues to pursue its current pricing and maximize-short-term profit strategy, it may continue to increase its profits for the next couple of years. (BlackBerry and Nokia grew earnings for a couple of years after some analysts began seeing the writing on the wall.)

I thought he was being genuinely worried about Apple losing platform and ecosystem share “in most of the world”, until I read the following passage.

Apple fans can talk all they want about how Apple is “like BMW,” but in a couple of key competitive respects, it isn’t. And if the gadget platform market behaves the way other platform markets have (think Windows), Apple and its fans may come to regret this short-term thinking in the end.

As if Blodget knew what Apple fans would want, let alone think.

So the only thing that matters ever is market share?

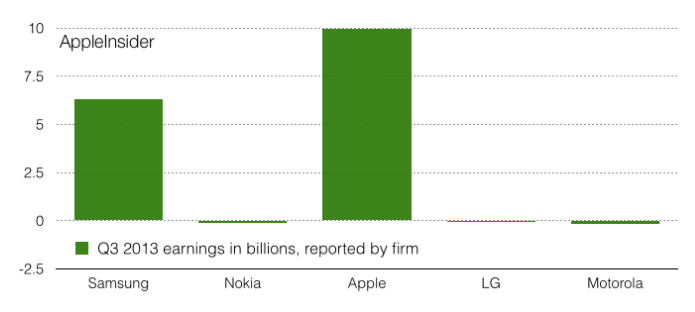

He’s basically suggesting it would have been better if Apple turned into a money-losing business with the dominating share, a position pretty much all handset makers other than Apple and Samsung find themselves in nowadays.

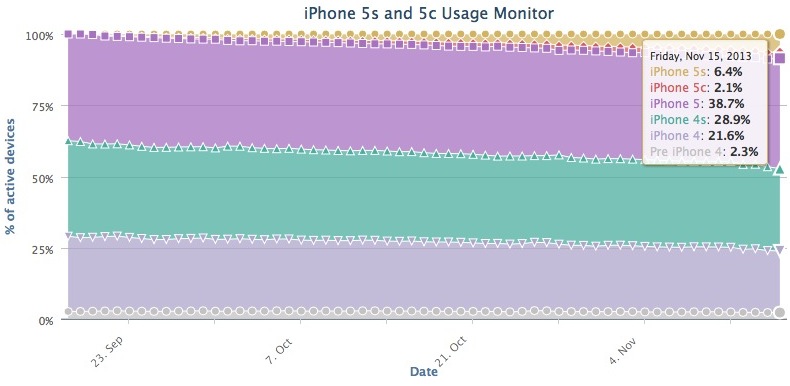

There’s Blodget’s chart and there’s this.

I’m pretty sure asking HTCs, Nokias and LGs of this world whether they would sacrifice their market share for Apple’s profitability would yield a negative response, unanimously.

It’s worth mentioning that Blodget has a history of failed predictions, linkbaits and downright insulting Apple criticism. It’s also worth remembering that Blodget in 2003 got charged with civil securities fraud by the U.S. Securities and Exchange Commission,prompting him to agree to a permanent ban from the securities industry and pay a hefty $2 million fine plus a $2 million disgorgement.

Maybe the fact that he is an Apple shareholder has something to do with such obvious attempts to manipulate the shares?

Then there’s Chinese website C Technology (via UnwiredView) which claims Apple’s iPhone 5c contract manufacturer Pegatron has reduced output from 320,000 units per day in October to just 80,000 units per day. The story adds that Foxconn, which also assembles the device, is now operating at a minimum capacity of 8-9,000 units per day.

Can’t wait to read WSJ’s take on that one…

Look, it doesn’t take a genius to figure out that the iPhone 5s sells better to early adopters than the iPhone 5c, which is basically a repackaged 2012 iPhone 5. One also doesn’t need to be a brainiac to figure out that the iPhone 5c is more of a slow-burner.

Such convoluted logic is the same as someone a year ago complaining about the 2011 iPhone 4s failing to outsell the then-new iPhone 5. Because that’s what the iPhone 5c is – a last year’s iPhone discounted by a $100, only colorful.

Wrapping up the criticism, Morgan Stanley analyzed data from market research firm IDC to claim the iPad now trails Android in both units shipped and revenues.

Morgan Stanley’s Katy Huberty wrote in a note to clients:

For the first time. Android devices accounted for a greater share of the market in revenue terms than iOS. Android revenue share reached 46.2 percent in 3Q13, for the first time exceeding iPad share of 45.6 percent.Android’s unit share grew to 66.7 percent from 58.5 percent a year ago, largely driven by Samsung and Lenovo, while iPad share declined to 29.7 percent from 40.2 percent.

She is referring to IDC data from two weeks ago which relegates Apple’s share of tablet shipments during the September quarter into the sub-30 percent category, their lowest level yet. However, the numbers don’t include new iPads which were announced in October.

And I’m not even mentioning the fact that IDC recently “discovered” ten million tablets it supposedly failed to count in its original estimates a year ago. As a result, the “research” firm has now retroactively lowered Apple’s tablet share.

In the same vein, Strategy Analytics – which counts Samsung as a client – invented millions of non-iPad tablets in order to artificially deflate Apple’s market position.

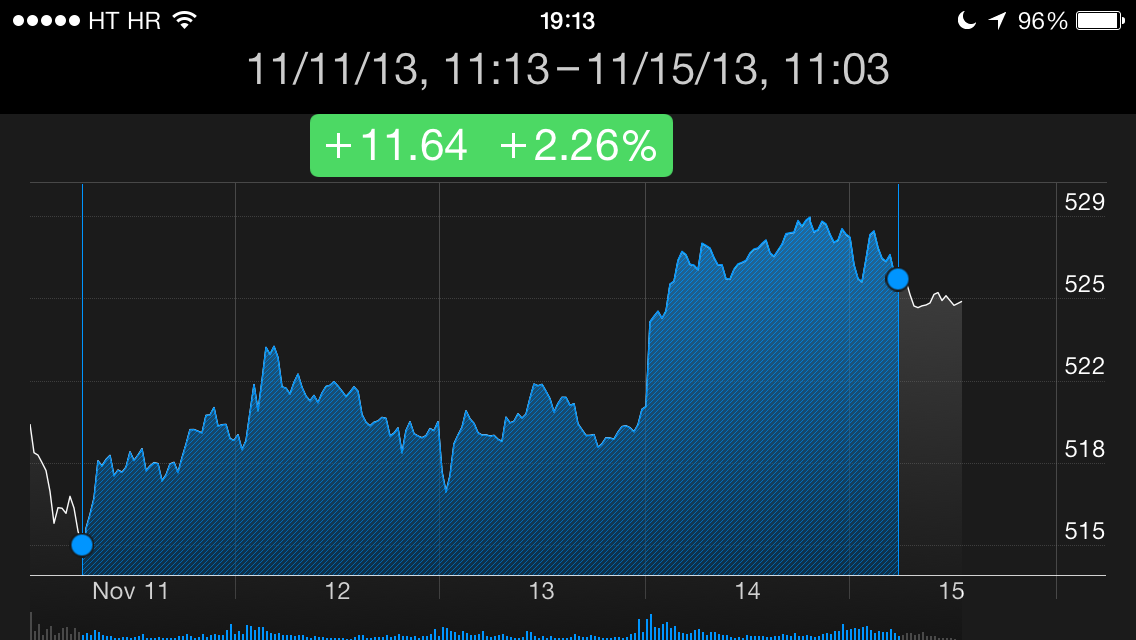

A snapshot of 5-day AAPL performance via iOS Stocks app, data provided by Yahoo.

I just wanted to share this with you and get off my chest that I’ve grown sick and tired of this ill-intended market share obsession, linkbait Apple hate and armchair analysis.

There’s no trusting disillusioned crazypants analysts – they promised us flying cars before and have been calling for an Apple television set “this Christmas” for years.

There’s also no trusting research firms that get estimates wrong and compare Apple’sreported unit sales to estimates, because virtually every other handset maker chose not to report sold units for the supposedly competitive reasons (case in point: Samsung and HTC, for example).

And there certainly isn’t trusting analysts’ friends in media whose harsh criticism of Apple is inconsistent and biased because they own shares of the company and pursue their own agenda.

Draw your own conclusions and by all means do feel free to disagree with me and vent your frustration down in the comments.

Disclosure: I don’t own shares of Apple or any other company for that matter. Do I get to keep my fanboy badge now?

No comments:

Post a Comment